Please subscribe :) youtube.com/geoffmobile

For more information about Pacific Soul Choir please visit www.thechorusstudio.com/

Please subscribe :) youtube.com/geoffmobile

For more information about Pacific Soul Choir please visit www.thechorusstudio.com/

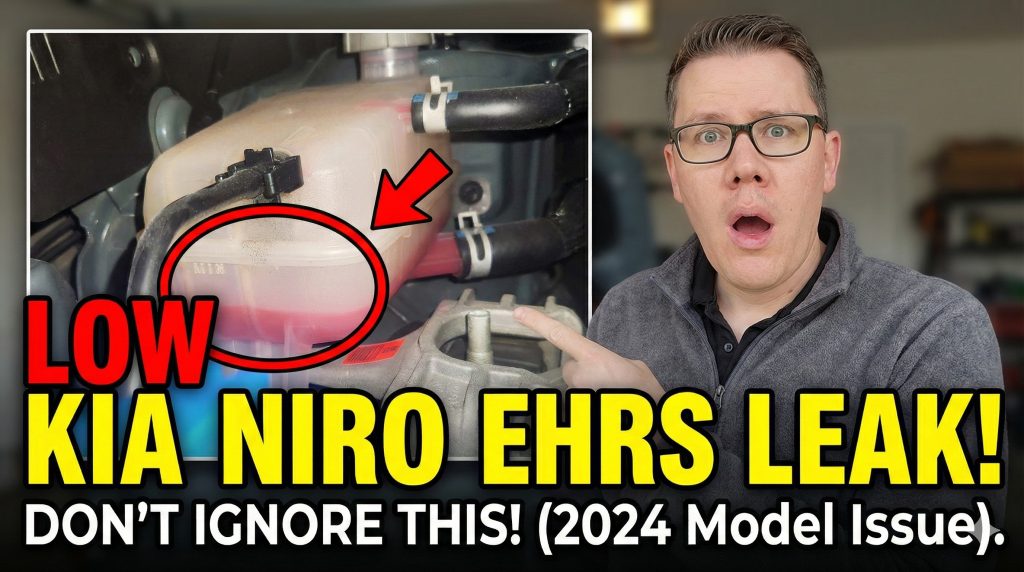

Coolant Leak Issue in 2024 Kia Niro Hybrid – EHRS Problem

Please subscribe :) youtube.com/geoffmobile

Hello, this is Geoff from geoffmobile.com

Today I’m going to do a very short video about a particular issue with the Kia Niro hybrid cars made by Kia.

We have a 2024 Niro with about 90,000 kilometers on it, and we noticed that the coolant level for the engine coolant—the one on the left side of the hood when you open up the engine—was very low. On the left side there’s a tank with a line that says “min” and a line that says “max.” I noticed the coolant level was actually way below the min. It was actually almost all gone.

If I hadn’t noticed that the coolant was low, it might have all leaked out and we would have been unable to drive anymore. So the question that I had was: where is this coolant going?

Searching on Gemini and online, I found one possible cause is that the coolant could be leaking out of what’s called the Exhaust Heat Recovery System (EHRS). This is a place where the coolant actually goes into the catalytic converter area and heat is exchanged with the exhaust air, and then it comes back through into the engine.

It turns out that we took the car to the dealer and this was the problem. There was a coolant leak in the exhaust heat recovery system. Because the car is less than 100,000 km, this repair is covered by warranty.

I guess the key takeaway is: if you see in your engine—like, always open up your engine every week and look at all the different containers of liquids and fluids. If you notice any that are below the min, you should definitely investigate the cause, especially for the coolant, because the coolant should never decrease below the min on its own unless there’s a leak.

The engine does not actually consume coolant. It’s a closed system. The coolant just flows through. So if the coolant is getting really low, that means that there is a leak somewhere. You really need to take it into a Kia authorized service center, like a dealership that has a service department, to have them diagnose where this leak is, because it could be a leak in many different places.

In my case, it was in the exhaust heat recovery system, which is a common issue on older Niros, but it looks like it’s also an issue on the newer generation of Niro hybrids as well. But the leak could also be in, say, your heater core—if you smell some sweet smell coming into your cabin—or it could be in a hose anywhere throughout the engine.

So definitely, if you have a leak or low fluid level, don’t just top it up and think you’re fine. Really have a dealer do an investigation into where it’s leaking, because that can be very important to discover the problem.

In our case, the dealer was able to diagnose the problem successfully and they ordered the parts to fix it. But unfortunately, there was only one of these heat exchangers left in Canada, and it was already taken by a different dealer. So right now, we’re waiting up to 8 weeks for the part to come from Korea.

They would not agree to do a bypass of the EHRS because that was not really the policy of Kia. They don’t ever bypass the EHRS. But if you do have a mechanic you trust who could do the bypass, that’s one way to work around this problem. It may decrease your engine efficiency a little bit by bypassing the EHRS, but if you search on Gemini or Google for “Kia Niro coolant EHRS bypass,” you’ll get a lot of resources and even some YouTube videos on how that can be done. But don’t do it yourself—I recommend having a trusted mechanic do that.

In the meantime, we are driving a courtesy car which is provided for free from the dealer. It’s amazing that they have great service, and obviously since it’s under 100,000 km, it’s covered by warranty, so we’re lucky in this case.

The moral of the story is: if you have any kind of vehicle, always go into the engine and just check the visible coolant levels of all the different tanks. Make sure you’re not running low on any of them, because that could indicate a serious issue with your engine or some leak somewhere, and it’s really good to investigate that.

If you have any questions about the Kia Niro hybrids and any low coolant levels or leaks, as well as this exhaust heat recovery system, please let me know in the comments below. Happy to answer your questions. Have a great day and talk to you soon.

Don’t forget to subscribe. Bye!

Geoff from geoffmobile.com explores the potential of summer as a fresh start. What if we’ve been thinking about resolutions all wrong? What if the best time to start fresh isn’t January 1st, but July 1st instead?

Please subscribe :) youtube.com/geoffmobile

Recorded at CTS Club Toastmasters

January 27th 2026

Bellevue, Washington, USA

Thanks for watching!

Cheers,

Geoff

geoffmobile.com

A Toastmasters speech exploring the potential of summer as a fresh start

What if we’ve been thinking about resolutions all wrong? What if the best time to start fresh isn’t January 1st, but July 1st instead?

Hello, Toastmasters and most welcome guests. My name is Geoff, and today I want to challenge the conventional wisdom around New Year’s resolutions by asking a simple question: if resolutions started in July instead of January, would people be more successful?

This is a genuinely interesting question when you think about it. For many people around the world, July represents a natural reset point. School finishes at the end of June in many places, and students begin their summer break in the first week of July. This creates a built-in transition period—a moment when routines change and new possibilities emerge.

We could easily imagine something called a “summer resolution” that begins in July and runs through the following June. This would give everyone a chance to start their summer with an excellent step in the right direction, whatever area of their life they want to improve.

Here’s where summer resolutions get really compelling. At least in the northern hemisphere, it’s usually quite warm starting in July. This opens up opportunities that simply don’t exist in the depths of winter.

Think about traditional gym resolutions. You have to drive to the gym, take the elevator up to the top floor, and then work out in an enclosed space. But in July? We can embrace outdoor activities instead. Get your sunscreen and start working out in outdoor gyms. Go for runs or walks. Make July the start of your fitness journey in the fresh air.

Instead of spending your whole summer just going to beaches and drinking drinks with friends (though there’s nothing wrong with that), we could go to parks, work out, and get some much-needed sunlight. That vitamin D we get from the sun—especially in the morning—is incredibly valuable.

Here’s something I’ve personally tried: if you go outside and get some natural sunlight in the first 30 minutes after you wake up, it sets your whole internal clock for the rest of the day. You naturally feel sleepy at nighttime. It does seem to work for me, and the science backs this up.

So here’s my proposal to everyone in the world: let’s start the idea of a summer resolution beginning in July. It’s a great way to harness the natural energy of summer, the change in routine that many people experience, and the abundance of outdoor opportunities that warm weather provides.

Why wait until January when July offers so many natural advantages? As one of my fellow Toastmasters noted, July is where most schools and other institutions wrap up and start fresh. It’s already a time of transition—we just need to recognize it as the opportunity it is.

Let’s make July the summer resolution. Yes, that’s a great idea.

This post is adapted from a Toastmasters speech delivered by Geoff. Visit geoffmobile.com for more insights on personal development, productivity, and making positive life changes.

Geoff from geoffmobile.com joins some choir friends for an evening of Karaoke at Switch on Robson in Vancouver Canada.

Please subscribe :)

youtube.com/geoffmobile

Track listing:

00:00 All Star (Smashmouth Cover)

03:25 Simply The Best (Tina Turner Cover)

08:31 I Thought About You (Frank Sinatra Cover)

“All Star” is a song by the American rock band Smash Mouth from their second studio album, Astro Lounge (1999). It was written by Greg Camp and produced by Eric Valentine.

“Simply the Best” (often called “The Best”) was written by Holly Knight and Mike Chapman, with Holly Knight famously rewriting parts for Tina Turner’s iconic 1989 cover, making it her signature song after Bonnie Tyler’s original release in 1988.

“I Thought About You” is a 1939 popular song composed by Jimmy Van Heusen with lyrics by Johnny Mercer.

Recorded at Switch Karaoke

1339 Robson St, Vancouver, BC, Canada V6E 1C6

switch-vancouver.ca/

Recorded in VR180 using Vuze XR and Zoom H2n.

Audio recorded in Spatial Audio mode and rendered to stereo using Reaper.

Audio edited in Audacity.

Video edited in Shotcut. ( See my VR 180 video editing tutorial here: www.youtube.com/watch?v=nZjHULdLF1o )

Upscaled to 8k (8640*4320 pixels) using ffmpeg.

Thanks for watching!

Cheers,

Geoff

geoffmobile.com

Geoff from geoffmobile.com gives a short speech on the topic of “What is Inflation?”.

Please subscribe :) youtube.com/geoffmobile

Recorded at CTS Club Toastmasters.

Thanks for watching!

Cheers,

Geoff

geoffmobile.com

Have you ever noticed how that morning coffee that cost you $3 a few years ago now runs closer to $5? Or how the price of groceries seems to climb higher with each passing year? That’s inflation at work, and understanding it is crucial for protecting your financial future.

At its core, inflation is the rise in prices across the economy over time. It’s that phenomenon we’ve all become uncomfortably familiar with—the fact that the same amount of money buys you less today than it did yesterday, last year, or a decade ago.

The most common way economists measure inflation is through the Consumer Price Index (CPI), which tracks the average price changes of a basket of goods and services that typical consumers buy. But here’s something interesting: inflation isn’t just one simple number.

Think of inflation as a spectrum of price changes across all products in the economy. While most things get more expensive, some actually become cheaper. Remember when flat-screen TVs first hit the market? A 40-inch model could set you back $4,000. Today, you can snag one for around $200. Technology advances at such a rapid pace that certain items buck the inflationary trend entirely.

Understanding what drives inflation helps demystify why your purchasing power seems to shrink over time. Let’s explore this with a thought experiment.

Imagine you’re selling a television on Facebook Marketplace for $500—a fair price based on current market conditions. Now, suppose the government suddenly gave every citizen a million dollars. You still have the same TV, but now everyone has significantly more money to spend. What happens to your asking price? It goes up, of course.

This illustrates a fundamental cause of inflation: when the money supply increases but the amount of available goods stays the same, prices rise. More dollars chasing the same number of products inevitably drives prices higher.

But inflation isn’t only about money supply. The supply side matters too. Consider what happens when factories shut down due to conflicts, natural disasters, or production issues. With fewer goods available but the same demand, prices climb. This is basic supply and demand economics in action—both sides of the equation can push prices upward.

Here’s the uncomfortable truth: keeping all your money in a regular bank account is one of the worst financial decisions you can make. That $100 bill you tucked under your mattress 20 years ago? It can’t buy nearly as much today as it could back then. Cash sitting idle loses value over time as inflation erodes its purchasing power.

If you have money you won’t need within the next year, invest it. Don’t let the word “investment” scare you—there are extremely safe options available.

In the United States, look into Certificates of Deposit (CDs). In Canada, these are called Guaranteed Investment Certificates (GICs) or term deposits. These allow you to deposit money with your bank for a fixed period (typically one year) and earn a guaranteed interest rate. If you want flexibility, opt for a cashable version that lets you access your money anytime while still earning interest.

This strategy applies to everyone—individuals and businesses alike. That interest you earn helps offset the inflation eating away at your money’s value.

For money you won’t need for five, ten, or twenty years, consider investments with higher growth potential: stock portfolios, bonds, real estate, or even cryptocurrency like Bitcoin. These come with more risk but also offer greater potential returns that can outpace inflation significantly.

If you own a home, one of the most cost-effective investments is simply making extra payments on your mortgage. By paying down your principal faster, you’ll pay less interest over the life of the loan—essentially earning a guaranteed return equal to your mortgage interest rate.

Inflation is an economic reality that affects everyone, everywhere. While you can’t stop prices from rising, you can protect yourself by understanding how inflation works and taking smart steps to preserve your wealth. The key is to keep your money working for you rather than letting it sit idle and lose value.

Whether you start with a simple GIC, explore mutual funds and ETFs, or make extra mortgage payments, the important thing is to take action. Your future self will thank you for not letting inflation silently erode your hard-earned money.

What steps are you taking to protect your finances against inflation? The best time to start was yesterday—the second-best time is today.